Try switching your portfolio to All Cash and watch how the graph looks like a comb over instead of a mountain. Why is this? Historically speaking, compared to cash, stocks have done a much better job of a) growing and b) keeping up with inflation. You may be surprised to find that an "All Stock" portfolio is risky, but often not as risky in the long run as an "All Cash" portfolio.Some insights into the results this tool unearths: For example, if you are retiring at age 60, but plan to draw social security at age 65, enter 5 in this box. Pension Start Year - the year you will start drawing your pension relative to your initial retirement year.

Annual Pension - the amount you estimate you will get per year from social security + pension. The amount is indexed to inflation starting in the year it kicks in.A similar rate is attainable with an FDIC insured money market account.

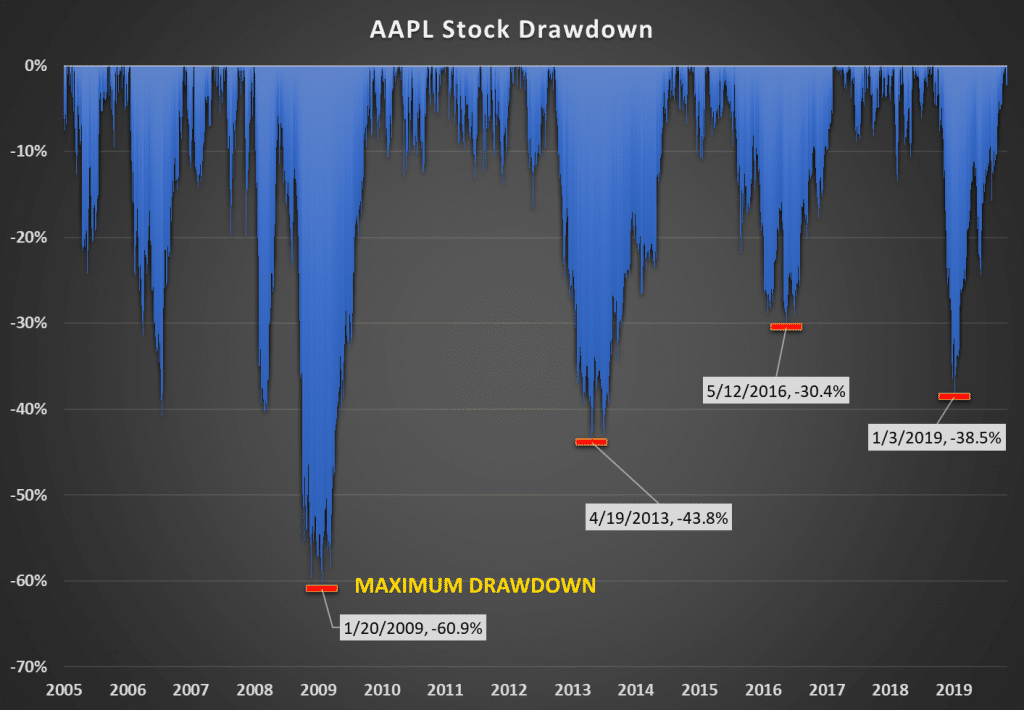

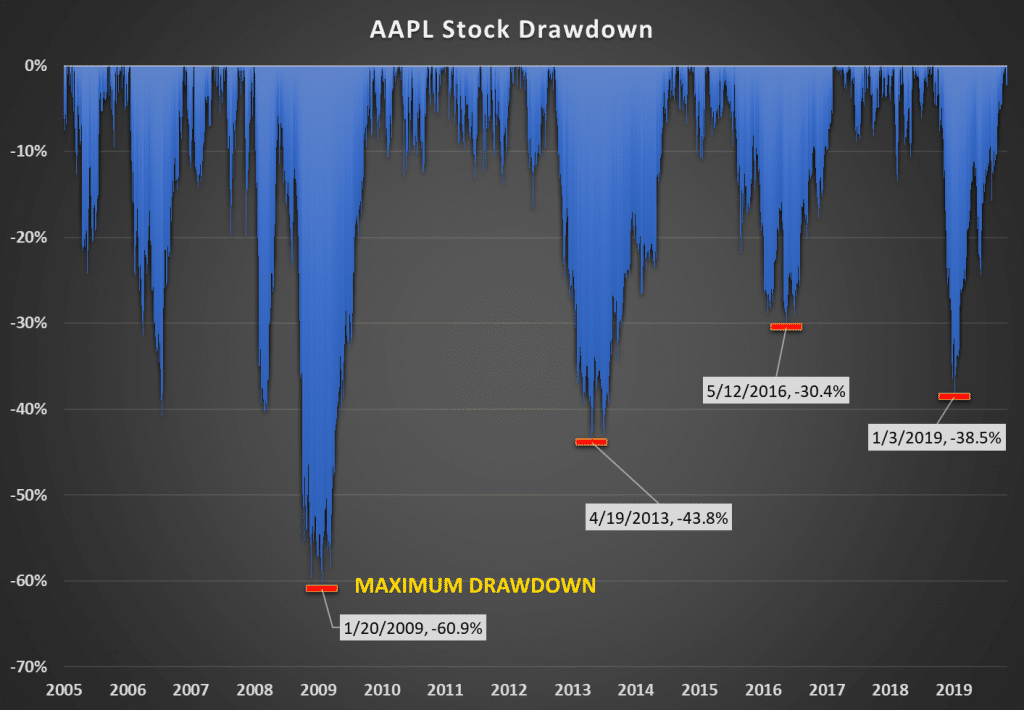

DRAWDOWN CALC SIMULATOR

The simulator uses the returns of 90 Day US Treasury Bills.

Cash - percent of funds to put into a 'risk free' investment. Bonds - percent of funds to put into 10 Year US Treasury Bonds, with returns including coupon and price appreciation. Stocks - percent of funds to put into the US S&P 500 Index. Portfolio Strategy - you can pick from the predefined allocations of Stocks, Bonds, and Cash, or enter your own. This aims to answer the classic question " Will I die rich or die broke?" . The calculator displays the percentage of simulations that exceeded the goal. Goal - how much you would like to have in the end. Withdraw Percent - the percent of your nest egg you plan to withdraw in the first year to live on, see Withdraw Amount notes. During the simulations the withdraw amount is adjusted for inflation. Withdraw Amount - how much you plan to withdraw in the first year (this amount does not count social security, pensions, or other income sources, just the amount you plan to take out of your nest egg each year). Savings at Retirement - how much money you have saved up before retiring and starting to draw on your nest egg. Length of Retirement - how long do you expect to live after you retire? Age 100? Age 85? To be conservative, enter a higher value. New for 12/2022 - optional Annual Pension and Pension Start Year added. It outputs the percent of time the simulated nest egg stayed above water or ran out of money. It is useful for comparing portfolio allocation outcomes, realistic withdraw rates, and setting a savings goal. This calculator generates simulation runs for each year of data in our historical dataset (1928 - present) based on what you enter above. It does not store any personal data.Related to this calculator, check out our Saving for Retirement Calculator and Portfolio Allocation Calculator. The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. The cookie is used to store the user consent for the cookies in the category "Performance". This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. The cookies is used to store the user consent for the cookies in the category "Necessary".

The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". The cookie is used to store the user consent for the cookies in the category "Analytics". These cookies ensure basic functionalities and security features of the website, anonymously. Necessary cookies are absolutely essential for the website to function properly.

0 kommentar(er)

0 kommentar(er)